Payroll cost calculator employers

DOR has created a withholding tax calculator to assist employers in computing the correct amount of Kentucky withholding tax for employees. Payroll refers to how employers pay their employees.

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

QuickBooks Payroll Software helps small businesses to run and manage payroll seamlessly and hassle-free.

. Knowing this a 1099 contractor needs to make a minimum of 30 more than W-2 employees to match employee compensation including benefits. The following tax returns wage reports and payroll tax deposit coupons are no longer available in paper. Quarterly Contribution Return and Report of Wages DE 9.

Job seekers can utilize our free salary calculator and salary information for career planning. Miss a payroll deadline and your employees dont get paid. Employers are required to give each employee a payslip with the details of their pay and any deductions.

These benefits include paid leave health insurance retirement savings and other legally required benefits. Social Security tax and Medicare tax. And the consequences can be huge.

FICA has two parts. Make sure the payroll software you choose lets you produce smart ideally customisable secure. The tax that both employers and employees must pay is the Federal Insurance Contributions Act FICA tax.

Quarterly Contribution Return and Report of Wages Continuation DE 9C Employer of Household Workers Annual Payroll Tax Return DE 3HW. Employer of Household Workers Quarterly Report of Wages. SalaryExpert provides employers and employees with the latest in cost of living data and salary survey data from around the world.

Miss a tax deadline and you may wind up paying fines. Submission of Wage and Tax information must be filed on or before January 31. This method is offered at no cost to the employer.

Staying on top of payroll and tax deadlines can be a big ordeal for even the most organized business owner. Because of the complex nature and various facets of payroll many companies choose to outsource payroll services. Texas Hourly Paycheck and Payroll Calculator.

Payroll covers all aspects of employee pay from preparing checks and withholding taxes to keeping records of every employees pay throughout the year. We help employers benchmark pay research cost of living find salary survey data and more. Wages and salaries cost employers 2591 while benefit costs were 1182.

Calculate their paycheck here and explore the true cost of hiring an employee in Texas. Try it save time and be compliant. By using a cloud payroll service you can avoid missing these types of crucial deadlines.

2022 Federal State Payroll Tax Rates For Employers

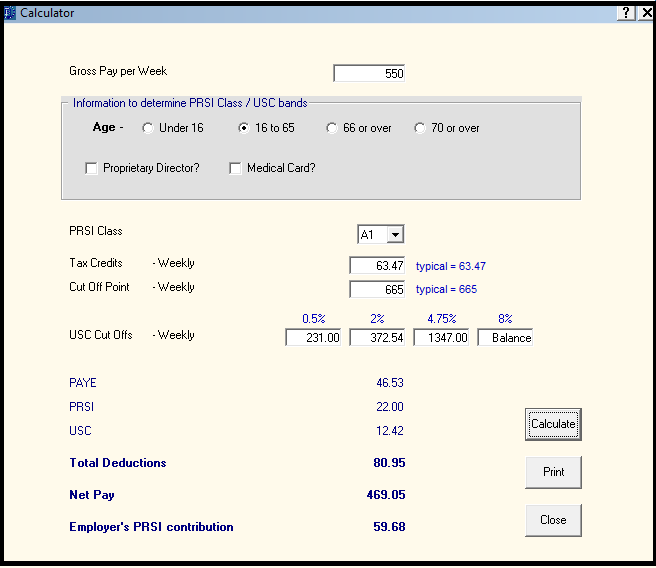

Calculator Documentation Thesaurus Payroll Manager Ireland 2018

F9bdnsmkp2rpjm

Costs Of Hiring European Employees

How To Calculate Employee Salary In China China Payroll

Dutch Payroll Administration For Companies In The Netherlands

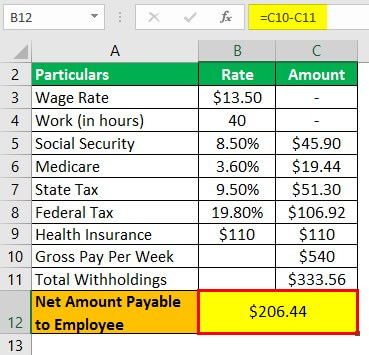

Payroll Formula Step By Step Calculation With Examples

Payroll Deductions Calculator For Estonian Companies Enty

Payroll Cost Payroll Service Costs Adp

What Does An Employee Cost Calculate The Employer Costs Expatax

Dutch Payroll Administration For Companies In The Netherlands

As An Employer What Do I Need To Know About The Payroll Tax Special Rate Expatax

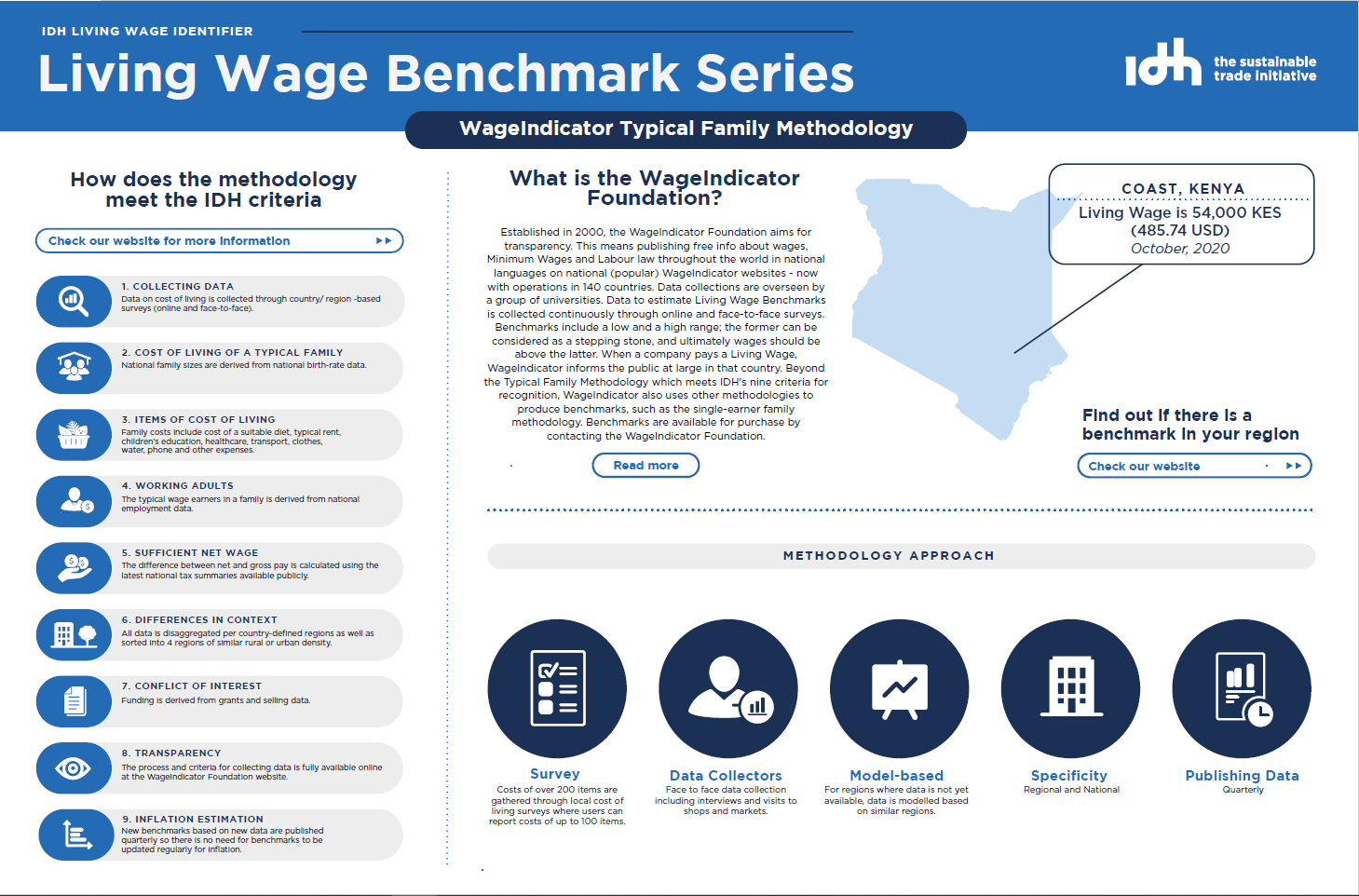

Step 1 What Is A Living Wage Idh The Sustainable Trade Initiative

Payroll Tax Calculator For Employers Gusto

Costs Of Hiring European Employees

Payslip In The Netherlands How Does It Work Blog Parakar

Reporting Season Is Upon Us And There S A Whole Raft Of Forms That Need Filing Soon P11d Forms Should Be Filed Quickbooks Payroll Payroll Payroll Accounting